When you start thinking about building a shampoo brand in the UAE, it helps to take a step back and look at what the local market actually wants. Hair care is a serious business here — according to Grand View Research, the UAE’s hair and scalp care sector was worth around USD 7.2 billion in 2024 and is expected to grow steadily to about USD 9.4 billion by 2030. That’s a healthy 4.4% CAGR, which shows there’s still plenty of room for new players to enter.

And if you drill down further, shampoos still dominate the category. They already make up more than 44% of the entire haircare market, and projections suggest they’ll keep growing at over 6% annually through 2030. In other words, it’s the one product type you really can’t go wrong with if you’re entering this space.

Now, once you know there’s demand, the next question is obvious: who’s going to make your products? This is where the UAE stands out. Over the years, the country has become a hub for cosmetics and personal care manufacturing, with plenty of shampoo factories offering services that go way beyond simple production lines. These companies can help with R&D, packaging ideas, customized formulas, and even regulatory requirements — basically taking a lot of the heavy lifting off your shoulders.

Priis Global, a Dubai-based manufacturer that’s quite active in the local OEM market. What sets them apart is their hands-on approach: instead of just producing bottles of shampoo, they’ll actually work with you on positioning your brand, tweaking formulas, and even choosing the right packaging style. For a new entrepreneur, that kind of guidance can save a lot of time (and mistakes).

Another reason small brands often choose Priis Global is their flexibility with order sizes. You don’t need to commit to massive volumes right away — they’ll happily work with smaller batches so you can test the waters. And if things take off, they also have the capacity to scale up production smoothly. Formula-wise, they cover the basics like repairing and oil-control shampoos, but you can also request adjustments to match specific market trends.

Shea Global Trading often gets mentioned when people talk about sustainability in the UAE’s beauty industry. Rather than chasing massive production runs, the team here prefers to work with brands that want their products to carry a bit of personality. For example, if you’re looking to highlight botanicals or tell a green story through your shampoo line, they’ll suggest formulas that naturally fit into that narrative.

Packaging is another area where they show flexibility. Some brands go for a very simple, eco-style bottle, while others want something more polished — both options are on the table. From what I’ve heard, their minimums aren’t too intimidating either, which explains why quite a few small businesses are comfortable starting with them.

As the name hints, this company leans heavily on the Ayurvedic tradition. The shampoos they make often revolve around scalp balance, herbal oils, and restorative blends. For brands aiming to capture that “herbal authenticity,” working with them feels like a natural fit.

What’s interesting is that they don’t just manufacture — they guide. A lot of founders aren’t experts in Ayurvedic ingredients, and that’s fine. Their team will sit down with you, suggest which herbs align with your market goals, and then translate that into a workable formula. The end result can be something as standard as a daily-use shampoo, or as niche as a specialty herbal line in smaller packaging.

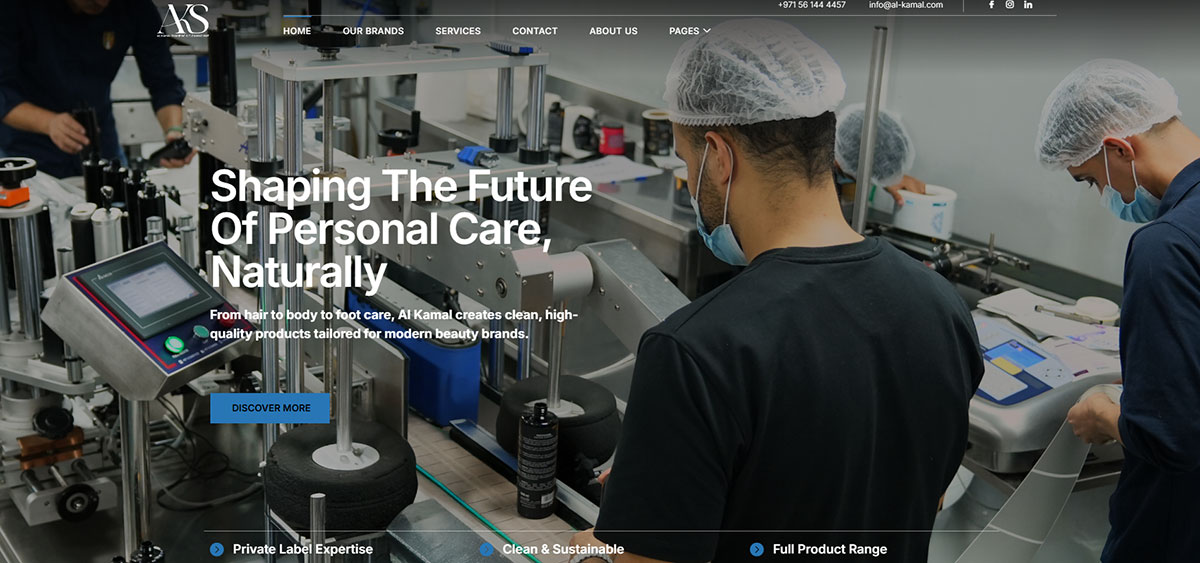

Al Kamal has been part of the UAE cosmetics space for over twenty years, which makes them one of the names most people recognize. Their certifications — ISO and GMP — give them credibility not just locally but also in export markets. So if your roadmap includes distribution outside the UAE, that’s a big box ticked.

Clients often describe the company as dependable. They move quickly from sampling to delivery, which helps brands cut down their time to market. The catch is that their minimum order is a bit higher than the boutique-style factories. But then again, what you get in return is scale, consistency, and a very broad library of tested formulas.

Don’t let the name fool you — they’re not only about soap. Over the years, The Camel Soap Factory has also added haircare, including shampoo, to its lineup. The most appealing part for many new brands is their willingness to handle smaller runs. If you want to test the waters with just a few hundred units, they’re one of the rare UAE factories that won’t turn you away.

On the compliance side, they carry certifications like GMP and ISO22716, so even small batches are produced under international standards. They also let you choose between classic hydrating formulas and slightly more specialized blends. For new entrepreneurs, this mix of flexibility and professionalism is a real plus.

Millia Cosmetics Group operates on a larger scale and covers more than just shampoos — they’re active in skincare and even makeup. This diversity gives them access to better R&D resources, which clients can leverage when they want innovative formulas.

Their lab capabilities are often highlighted by partners. If you’re aiming for something that aligns with global haircare trends — sulfate-free, vegan, or silicone-free — they’re able to turn around prototypes quickly. It makes them a strong fit for brands thinking beyond a single product launch and looking at long-term growth.

Fayfa has been around long enough to become a trusted name in the region’s manufacturing sector. They don’t just do shampoos; their portfolio also includes personal care and household items. That kind of scale means they’re very comfortable handling big-volume orders without compromising on quality.

For private label clients, the trade-off is clear. You’ll likely face higher MOQs than with smaller factories, but in exchange you gain reliability and a partner used to meeting international compliance. For established brands, or those with distribution channels already in place, Fayfa offers the kind of stability that’s hard to argue with.

NG Beauty World is a younger player compared to some of the giants, but they’ve made a name for themselves in Dubai’s free zone. Their focus is on being nimble — offering contract and private label manufacturing that can be adapted to different market needs.

The feedback I’ve seen is that they’re particularly strong on packaging creativity. Whether you want a sleek, modern look for the shelves or a boutique-style finish, they can deliver. MOQs are fairly approachable too, which makes them suitable for both startups and established companies experimenting with a new haircare line.

As a professional hair care product manufacturer, Xiran Cosmetics specializes in providing UAE brands with high-quality, customizable private label shampoo solutions.

We focus on developing various functional shampoos, including nourishing repair, anti-dandruff and oil control, smooth and silky, hair growth, and color-treated hair protection series.

| Comparison Item | UAE Shampoo Manufacturers | Xiran Cosmetics |

|---|---|---|

| Product Performance | Focus on traditional formulations with basic hair care benefits | Offers diverse shampoo lines including nourishing, repairing, anti-dandruff, oil control, and other functional effects |

| R&D Speed | Longer development cycles; slower innovation | In-house R&D team with sample development in 2–4 weeks, rapid market responsiveness |

| Service Flexibility | Standardized services, mainly for large-scale production | Highly flexible OEM/ODM services, supports small-batch customization, ideal for startups |

| Minimum Order Quantity (MOQ) | Usually high, suitable for bulk production | Low MOQ starting from 1,000 units, ideal for small launches or market testing |

| Regulations & Compliance | Complies with local UAE cosmetic regulations | Fully compliant with EU, US, and UAE standards, certified with ISO, GMPC, MSDS |

Whether you are a startup brand or an established enterprise, we offer comprehensive OEM/ODM services including formula customization, packaging design, and regulatory compliance support to help you rapidly launch high-quality shampoo products tailored to local market demands.

In the UAE, the shampoo manufacturing industry has established a mature contract manufacturing (OEM) chain. Whether you're a small, early-stage brand or an established company planning market expansion, you can find a suitable partner. UAE shampoo manufacturers generally excel in formula customization, flexible MOQs, custom packaging, and international certifications.

Beyond UAE shampoo manufacturers, many entrepreneurs are also turning their attention to Chinese shampoo factories. The reason is simple: China's scale and maturity in the cosmetics OEM sector are virtually unparalleled globally. Whether it's basic nourishing formulas, oil-control formulas, or functional shampoos for dry, frizzy hair, Chinese manufacturers have a comprehensive library of formulas to choose from.

Furthermore, their R&D teams can often quickly adjust ingredient ratios based on customer needs, even developing proprietary formulas. This flexibility is crucial for many small and medium-sized brands.

In terms of the supply chain, Chinese shampoo manufacturers have strong cost control capabilities, and their MOQs (minimum order quantities) are often more favorable than those of European or Middle Eastern factories, meaning even startups can find suitable partnerships.

Combined with supporting packaging factories and fast delivery, Chinese factories can often help customers bring high-quality shampoo products to market in a shorter time and at a reasonable price. This is why many overseas brands choose to locate their production in China.